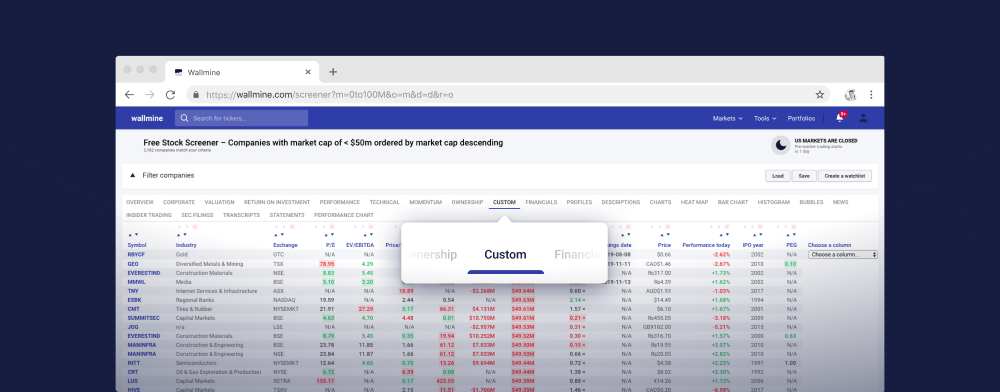

Free Stock Screener

Load Save Create a watchlist Help| Market cap | $3.51M |

|---|---|

| Enterprise value | N/A |

| Revenue | N/A |

|---|---|

| EBITDA | N/A |

| Income | -$9.33 |

| Revenue Q/Q | N/A |

| Revenue Y/Y | N/A |

| P/E | 0.00 |

|---|---|

| Forward P/E | N/A |

| EV/Sales | N/A |

| EV/EBITDA | N/A |

| EV/EBIT | N/A |

| PEG | N/A |

| Price/Sales | N/A |

| P/FCF | N/A |

| Price/Book | 0.22 |

| Book/Share | 1.44 |

| Cash/Share | N/A |

| FCF yield | -287.16% |

| Volume | 1.610M / N/A |

|---|---|

| Relative vol. | N/A |

| EPS | N/A |

|---|---|

| EPS Q/Q | 39,017.65% |

| Est. EPS Q/Q | -35.71% |

| Profit margin | N/A |

|---|---|

| Oper. margin | N/A |

| Gross margin | N/A |

| EBIT margin | N/A |

| EBITDA margin | N/A |

| Ret. on assets | -65.01% |

|---|---|

| Ret. on equity | -75.04% |

| ROIC | -50.94% |

| ROCE | -102.89% |

| Debt/Equity | N/A |

|---|---|

| Net debt/EBITDA | 2.57 |

| Current ratio | 14.30 |

| Quick ratio | 14.30 |

| Volatility | 49.38% |

|---|---|

| Beta | 1.07 |

| RSI | 36.46 |

|---|

| Insider ownership | 0.10% |

|---|---|

| Inst. ownership | 4.53% |

| Shares outst. | 3.105M |

|---|---|

| Shares float | 0.000 0.00% |

| Short % of float | 2.43% |

| Short ratio | 0.09 |

| Dividend | N/A |

|---|---|

| Dividend yield | N/A |

| Payout ratio | N/A |

| Payment date | N/A |

| Ex-dividend date | N/A |

| Earnings date | N/A |

| Market cap | $4.26B |

|---|---|

| Enterprise value | $6.17B |

| Revenue | $2.444B |

|---|---|

| EBITDA | $1.688B |

| Income | $810.946M |

| Revenue Q/Q | 15.22% |

| Revenue Y/Y | -7.11% |

| P/E | 5.61 |

|---|---|

| Forward P/E | 6.13 |

| EV/Sales | 2.52 |

| EV/EBITDA | 3.66 |

| EV/EBIT | 6.26 |

| PEG | 0.08 |

| Price/Sales | 1.74 |

| P/FCF | 8.58 |

| Price/Book | 1.18 |

| Book/Share | 33.19 |

| Cash/Share | 6.17 |

| FCF yield | 11.66% |

| Volume | 1.498M / N/A |

|---|---|

| Relative vol. | N/A |

| EPS | 6.97 |

|---|---|

| EPS Q/Q | 21,800.00% |

| Est. EPS Q/Q | 156.76% |

| Profit margin | 34.45% |

|---|---|

| Oper. margin | 39.86% |

| Gross margin | 76.26% |

| EBIT margin | 40.34% |

| EBITDA margin | 69.05% |

| Ret. on assets | 12.71% |

|---|---|

| Ret. on equity | 22.28% |

| ROIC | 16.63% |

| ROCE | 16.28% |

| Debt/Equity | 0.76 |

|---|---|

| Net debt/EBITDA | 2.46 |

| Current ratio | 1.29 |

| Quick ratio | 1.29 |

| Volatility | 5.22% |

|---|---|

| Beta | 0.99 |

| RSI | 33.68 |

|---|

| Insider ownership | 1.66% |

|---|---|

| Inst. ownership | 92.40% |

| Shares outst. | 114.418M |

|---|---|

| Shares float | 0.000 0.00% |

| Short % of float | 5.49% |

| Short ratio | 2.71 |

| Dividend | $0.69 |

|---|---|

| Dividend yield | 1.51% |

| Payout ratio | 9.90% |

| Payment date | N/A |

| Ex-dividend date | N/A |

| Earnings date | 7 Nov 2024 |

| Market cap | $761.05M |

|---|---|

| Enterprise value | N/A |

| Revenue | N/A |

|---|---|

| EBITDA | N/A |

| Income | руб3.144B |

| Revenue Q/Q | 1.07% |

| Revenue Y/Y | 27.21% |

| P/E | 0.00 |

|---|---|

| Forward P/E | N/A |

| EV/Sales | 0.05 |

| EV/EBITDA | N/A |

| EV/EBIT | 32.08 |

| PEG | 0.50 |

| Price/Sales | 2.28 |

| P/FCF | 0.11 |

| Price/Book | 6.92 |

| Book/Share | 2.17 |

| Cash/Share | N/A |

| FCF yield | 17.23% |

| Volume | 1.000 / 0.000 |

|---|---|

| Relative vol. | N/A |

| EPS | N/A |

|---|---|

| EPS Q/Q | 14,486.36% |

| Est. EPS Q/Q | 90.91% |

| Profit margin | N/A |

|---|---|

| Oper. margin | 37.52% |

| Gross margin | N/A |

| EBIT margin | 37.52% |

| EBITDA margin | 0.68% |

| Ret. on assets | 15.34% |

|---|---|

| Ret. on equity | 75.35% |

| ROIC | 27.41% |

| ROCE | 53.64% |

| Debt/Equity | N/A |

|---|---|

| Net debt/EBITDA | 193.75 |

| Current ratio | 0.77 |

| Quick ratio | 0.52 |

| Volatility | 0.36% |

|---|---|

| Beta | 0.00 |

| RSI | N/A |

|---|

| Insider ownership | 31.92% |

|---|---|

| Inst. ownership | 50.60% |

| Shares outst. | 50.636M |

|---|---|

| Shares float | 0.000 0.00% |

| Short % of float | N/A |

| Short ratio | 1.05 |

| Dividend | $0.00 |

|---|---|

| Dividend yield | 0.00% |

| Payout ratio | N/A |

| Payment date | N/A |

| Ex-dividend date | N/A |

| Earnings date | N/A |

OZON

| Market cap | $2.42B |

|---|---|

| Enterprise value | $2.06B |

| Revenue | руб342.436B |

|---|---|

| EBITDA | -руб41.03 |

| Income | -руб34.36 |

| Revenue Q/Q | 60.93% |

| Revenue Y/Y | N/A |

| P/E | N/A |

|---|---|

| Forward P/E | N/A |

| EV/Sales | 0.32 |

| EV/EBITDA | N/A |

| EV/EBIT | N/A |

| PEG | N/A |

| Price/Sales | 0.37 |

| P/FCF | 0.16 |

| Price/Book | -7.70 |

| Book/Share | -1.51 |

| Cash/Share | 10.14 |

| FCF yield | 12.14% |

| Volume | 112.254k / 0.000 |

|---|---|

| Relative vol. | N/A |

| EPS | N/A |

|---|---|

| EPS Q/Q | 13,998.57% |

| Est. EPS Q/Q | 16,220.00% |

| Profit margin | -21.00% |

|---|---|

| Oper. margin | -8.53% |

| Gross margin | 56.16% |

| EBIT margin | -4.70% |

| EBITDA margin | -11.98% |

| Ret. on assets | -12.66% |

|---|---|

| Ret. on equity | 291.16% |

| ROIC | -17.22% |

| ROCE | -12.74% |

| Debt/Equity | -18.11 |

|---|---|

| Net debt/EBITDA | -4.96 |

| Current ratio | 0.85 |

| Quick ratio | 0.66 |

| Volatility | 0.00% |

|---|---|

| Beta | 0.42 |

| RSI | N/A |

|---|

| Insider ownership | 1.04% |

|---|---|

| Inst. ownership | 51.64% |

| Shares outst. | 208.322M |

|---|---|

| Shares float | 71.665M 34.40% |

| Short % of float | N/A |

| Short ratio | 3.17 |

| Dividend | N/A |

|---|---|

| Dividend yield | N/A |

| Payout ratio | N/A |

| Payment date | N/A |

| Ex-dividend date | N/A |

| Earnings date | N/A |

| Market cap | $87.74M |

|---|---|

| Enterprise value | $179.09M |

| Revenue | CAD$216.270M |

|---|---|

| EBITDA | CAD$43.669M |

| Income | -CAD$7.47 |

| Revenue Q/Q | 0.19% |

| Revenue Y/Y | -10.43% |

| P/E | N/A |

|---|---|

| Forward P/E | 10.63 |

| EV/Sales | 1.09 |

| EV/EBITDA | 5.38 |

| EV/EBIT | N/A |

| PEG | 0.04 |

| Price/Sales | 0.53 |

| P/FCF | 3.10 |

| Price/Book | 0.39 |

| Book/Share | 7.71 |

| Cash/Share | 0.16 |

| FCF yield | 24.60% |

| Volume | 2.000 / 920.000 |

|---|---|

| Relative vol. | 0.00 × |

| EPS | -0.19 |

|---|---|

| EPS Q/Q | 10,976.92% |

| Est. EPS Q/Q | -78.57% |

| Profit margin | -3.09% |

|---|---|

| Oper. margin | 0.59% |

| Gross margin | 27.41% |

| EBIT margin | N/A |

| EBITDA margin | 20.19% |

| Ret. on assets | -1.69% |

|---|---|

| Ret. on equity | -2.51% |

| ROIC | -3.77% |

| ROCE | 0.00% |

| Debt/Equity | 0.50 |

|---|---|

| Net debt/EBITDA | 9.66 |

| Current ratio | 1.82 |

| Quick ratio | 1.68 |

| Volatility | 1.88% |

|---|---|

| Beta | 1.71 |

| RSI | 56.32 |

|---|

| Insider ownership | 30.23% |

|---|---|

| Inst. ownership | 49.70% |

| Shares outst. | 33.841M |

|---|---|

| Shares float | 6.577M 19.44% |

| Short % of float | 0.00% |

| Short ratio | 1.80 |

| Dividend | CAD$0.00 |

|---|---|

| Dividend yield | 0.00% |

| Payout ratio | 0.00% |

| Payment date | N/A |

| Ex-dividend date | N/A |

| Earnings date | N/A |

| Market cap | $17.36M |

|---|---|

| Enterprise value | N/A |

| Revenue | $124.238M |

|---|---|

| EBITDA | N/A |

| Income | -$3.41 |

| Revenue Q/Q | 34.67% |

| Revenue Y/Y | 23.44% |

| P/E | 0.00 |

|---|---|

| Forward P/E | N/A |

| EV/Sales | 0.18 |

| EV/EBITDA | N/A |

| EV/EBIT | 20.52 |

| PEG | 1.75 |

| Price/Sales | 0.14 |

| P/FCF | N/A |

| Price/Book | 1.18 |

| Book/Share | 2.85 |

| Cash/Share | 1.34 |

| FCF yield | -19.72% |

| Volume | 39.639k / N/A |

|---|---|

| Relative vol. | N/A |

| EPS | N/A |

|---|---|

| EPS Q/Q | 7,800.00% |

| Est. EPS Q/Q | -150.00% |

| Profit margin | -3.82% |

|---|---|

| Oper. margin | -2.58% |

| Gross margin | 14.76% |

| EBIT margin | -2.49% |

| EBITDA margin | 1.55% |

| Ret. on assets | -6.40% |

|---|---|

| Ret. on equity | -23.30% |

| ROIC | -7.32% |

| ROCE | -16.22% |

| Debt/Equity | 2.50 |

|---|---|

| Net debt/EBITDA | -3.59 |

| Current ratio | 1.06 |

| Quick ratio | 1.06 |

| Volatility | 8.19% |

|---|---|

| Beta | 0.99 |

| RSI | 41.84 |

|---|

| Insider ownership | 9.85% |

|---|---|

| Inst. ownership | 11.97% |

| Shares outst. | 9.652M |

|---|---|

| Shares float | 0.000 0.00% |

| Short % of float | 0.61% |

| Short ratio | 1.55 |

| Dividend | N/A |

|---|---|

| Dividend yield | N/A |

| Payout ratio | N/A |

| Payment date | N/A |

| Ex-dividend date | N/A |

| Earnings date | 12 Nov 2024 |

| Market cap | $3.25M |

|---|---|

| Enterprise value | N/A |

| Revenue | $12.023M |

|---|---|

| EBITDA | N/A |

| Income | -$16.11 |

| Revenue Q/Q | -47.94% |

| Revenue Y/Y | -20.92% |

| P/E | 0.00 |

|---|---|

| Forward P/E | N/A |

| EV/Sales | 0.17 |

| EV/EBITDA | N/A |

| EV/EBIT | N/A |

| PEG | N/A |

| Price/Sales | 0.27 |

| P/FCF | N/A |

| Price/Book | 0.98 |

| Book/Share | 0.49 |

| Cash/Share | 0.46 |

| FCF yield | -87.25% |

| Volume | 108.831k / 162.267k |

|---|---|

| Relative vol. | 0.67 × |

| EPS | N/A |

|---|---|

| EPS Q/Q | 6,900.00% |

| Est. EPS Q/Q | -38.57% |

| Profit margin | -65.46% |

|---|---|

| Oper. margin | -60.67% |

| Gross margin | 53.61% |

| EBIT margin | -88.70% |

| EBITDA margin | -94.10% |

| Ret. on assets | -136.86% |

|---|---|

| Ret. on equity | -431.13% |

| ROIC | -75.81% |

| ROCE | -3,385.40% |

| Debt/Equity | 1.73 |

|---|---|

| Net debt/EBITDA | 2.75 |

| Current ratio | 0.62 |

| Quick ratio | 0.43 |

| Volatility | 69.73% |

|---|---|

| Beta | 0.00 |

| RSI | 40.42 |

|---|

| Insider ownership | 16.05% |

|---|---|

| Inst. ownership | 2.57% |

| Shares outst. | 4.886M |

|---|---|

| Shares float | 0.000 0.00% |

| Short % of float | 2.09% |

| Short ratio | 0.58 |

| Dividend | N/A |

|---|---|

| Dividend yield | N/A |

| Payout ratio | N/A |

| Payment date | N/A |

| Ex-dividend date | N/A |

| Earnings date | 7 Nov 2024 |

| Market cap | $4.48B |

|---|---|

| Enterprise value | $5.72B |

| Revenue | $37.254B |

|---|---|

| EBITDA | $3.752B |

| Income | $779.400M |

| Revenue Q/Q | -4.60% |

| Revenue Y/Y | -11.43% |

| P/E | 4.84 |

|---|---|

| Forward P/E | 4.77 |

| EV/Sales | 0.15 |

| EV/EBITDA | 1.52 |

| EV/EBIT | 5.25 |

| PEG | 0.45 |

| Price/Sales | 0.12 |

| P/FCF | 17.06 |

| Price/Book | 0.69 |

| Book/Share | 45.11 |

| Cash/Share | 12.40 |

| FCF yield | 5.86% |

| Volume | 2.586M / N/A |

|---|---|

| Relative vol. | N/A |

| EPS | 6.43 |

|---|---|

| EPS Q/Q | 6,533.33% |

| Est. EPS Q/Q | 229.69% |

| Profit margin | 5.59% |

|---|---|

| Oper. margin | 3.11% |

| Gross margin | 6.26% |

| EBIT margin | 2.93% |

| EBITDA margin | 10.07% |

| Ret. on assets | 5.47% |

|---|---|

| Ret. on equity | 12.02% |

| ROIC | 21.17% |

| ROCE | 11.10% |

| Debt/Equity | 1.20 |

|---|---|

| Net debt/EBITDA | 0.46 |

| Current ratio | 1.42 |

| Quick ratio | 0.75 |

| Volatility | 4.31% |

|---|---|

| Beta | 0.82 |

| RSI | 28.50 |

|---|

| Insider ownership | 9.85% |

|---|---|

| Inst. ownership | 80.89% |

| Shares outst. | 117.150M |

|---|---|

| Shares float | 0.000 0.00% |

| Short % of float | 16.48% |

| Short ratio | 3.54 |

| Dividend | $1.00 |

|---|---|

| Dividend yield | 3.10% |

| Payout ratio | 15.55% |

| Payment date | N/A |

| Ex-dividend date | N/A |

| Earnings date | 31 Oct 2024 |

| Market cap | $283.85M |

|---|---|

| Enterprise value | $364.40M |

| Revenue | N/A |

|---|---|

| EBITDA | -$9.70 |

| Income | -$25.06 |

| Revenue Q/Q | N/A |

| Revenue Y/Y | N/A |

| P/E | N/A |

|---|---|

| Forward P/E | -34.00 |

| EV/Sales | N/A |

| EV/EBITDA | N/A |

| EV/EBIT | N/A |

| PEG | N/A |

| Price/Sales | N/A |

| P/FCF | N/A |

| Price/Book | 0.86 |

| Book/Share | 3.31 |

| Cash/Share | 0.08 |

| FCF yield | -10.15% |

| Volume | 100.000 / 100.000 |

|---|---|

| Relative vol. | 1.00 × |

| EPS | -0.25 |

|---|---|

| EPS Q/Q | 6,500.00% |

| Est. EPS Q/Q | -100.00% |

| Profit margin | 0.00% |

|---|---|

| Oper. margin | 0.00% |

| Gross margin | N/A |

| EBIT margin | N/A |

| EBITDA margin | N/A |

| Ret. on assets | -1.58% |

|---|---|

| Ret. on equity | -7.10% |

| ROIC | -1.68% |

| ROCE | 0.00% |

| Debt/Equity | 0.50 |

|---|---|

| Net debt/EBITDA | -23.81 |

| Current ratio | 20.11 |

| Quick ratio | 0.11 |

| Volatility | 0.80% |

|---|---|

| Beta | 0.59 |

| RSI | 48.36 |

|---|

| Insider ownership | 71.38% |

|---|---|

| Inst. ownership | 4.00% |

| Shares outst. | 100.877M |

|---|---|

| Shares float | 28.821M 28.57% |

| Short % of float | 0.01% |

| Short ratio | 6.90 |

| Dividend | N/A |

|---|---|

| Dividend yield | N/A |

| Payout ratio | N/A |

| Payment date | N/A |

| Ex-dividend date | N/A |

| Earnings date | N/A |

| Market cap | $6.05M |

|---|---|

| Enterprise value | N/A |

| Revenue | $5.493B |

|---|---|

| EBITDA | N/A |

| Income | -$1.07 |

| Revenue Q/Q | -28.11% |

| Revenue Y/Y | N/A |

| P/E | N/A |

|---|---|

| Forward P/E | N/A |

| EV/Sales | 0.23 |

| EV/EBITDA | N/A |

| EV/EBIT | N/A |

| PEG | N/A |

| Price/Sales | 0.00 |

| P/FCF | N/A |

| Price/Book | 0.02 |

| Book/Share | 33.81 |

| Cash/Share | N/A |

| FCF yield | -1,234.37% |

| Volume | 1.855M / 379.632k |

|---|---|

| Relative vol. | 4.89 × |

| EPS | N/A |

|---|---|

| EPS Q/Q | 6,400.00% |

| Est. EPS Q/Q | 362.50% |

| Profit margin | N/A |

|---|---|

| Oper. margin | -23.09% |

| Gross margin | N/A |

| EBIT margin | -20.25% |

| EBITDA margin | 3.70% |

| Ret. on assets | -35.74% |

|---|---|

| Ret. on equity | 2,507.87% |

| ROIC | -3.29% |

| ROCE | -2.99% |

| Debt/Equity | N/A |

|---|---|

| Net debt/EBITDA | 34.19 |

| Current ratio | 0.44 |

| Quick ratio | 0.26 |

| Volatility | 11.33% |

|---|---|

| Beta | N/A |

| RSI | 87.26 |

|---|

| Insider ownership | 11.83% |

|---|---|

| Inst. ownership | 65.79% |

| Shares outst. | 9.986M |

|---|---|

| Shares float | 8.799M 88.11% |

| Short % of float | 33.77% |

| Short ratio | 3.11 |

| Dividend | N/A |

|---|---|

| Dividend yield | N/A |

| Payout ratio | N/A |

| Payment date | N/A |

| Ex-dividend date | N/A |

| Earnings date | N/A |